Are You Saving Enough?

Maybe I’m an annoying guy, but I often ask people, Are you saving enough? That is generally met with the clearing of the throat or various other methods of stalling while they think of a thoughtful response. If you can’t answer that question, we should talk more.

The question often triggers more questions, like:

Enough for what?

How do I determine what is enough?

Are my savings at the bank generating enough returns to truly help me?

I’m sure there are more questions this initial question may generate, but these three are enough to get the conversation started. The answer to the first question is generally retirement, but it could also include more basic needs like college tuition, a house or another car.

College tuition is a common goal for young parents. It’s a worthy goal. A college education is said to almost double the lifetime income of a successful graduate. Of course, one should pay close attention to the job market for the preferred area of study. While engineers and business majors usually generate plenty of income to justify the cost of college, those choosing music and theater degrees might find themselves re-entering college in the future to craft their skills toward a more commercially applicable endeavor. Before you jump out of your chair, know that I have met many successful entertainers and it can be done, but for the sake of more highly probably success, I offer the aforementioned advice (think before you agree with an 18-year-old on spending $50,000 per year on their one true passion). Simple conversations can be helpful but often riddled with emotions. I have experienced this firsthand.

Saving for a house or a car can be great goals. I’m a huge advocate of deferred gratification (doing without the cool stuff now while you save for the future). If you save enough for the house to make a handsome downpayment (20% or more) it could lower your monthly mortgage payment to a level that allows you to manage more savings in conjunction with having the cool house. This compromise between deferred gratification and instant gratification may be enough to keep you sane as you don’t have to save all of your money. A financial plan can tell you much to save, thus answering the initial question and when you can make the big purchase. You must exercise some patience and restrain your spending if you ever want to have more assets in the future. The same can be said for retirement. Set a date you would like to retire, set a monthly spending goal for the future beginning on that day. Calculate how much you would need to have at that date. Assess your current assets and how much you should save to reach that goal.

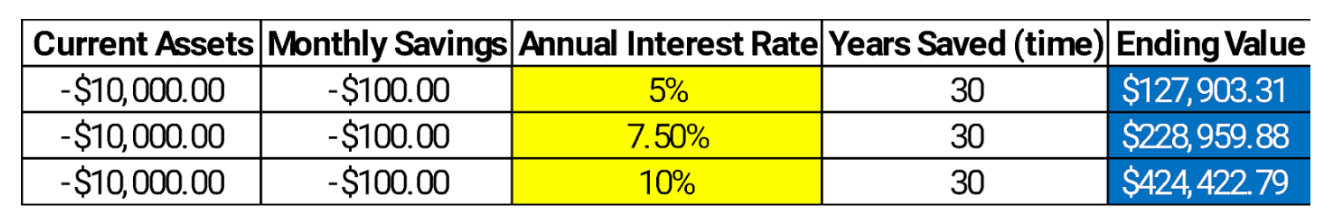

In the midst of this process, we will help you determine how much the money you save is likely to grow in the financial market. The S&P 500 has a long history of returns above 10% annually. If your goal is many years in the future, it is likely that the money you must save is much lower than the final dollar amount you need. This is because of the benefits of compounding of interest. When you save the right way by investing your money in assets with a proper amount of risk, you realize you can make much more than just leaving your cash at the bank generating almost nothing in returns. With proper coaching and risk management, your money can work as hard as you toward your long-term goals. As you approach the point of need (college, house, retirement, etc.) we can work with you to modify your portfolio risk by using bonds that are set to mature when you need them and in the amount you need. Many people don’t realize how important it is to make the right investment choice along the path to your goals. The table below shows just how much difference this can make.

Starting with $10,000 and saving $100 per month for 30 years (360 months) in each case, you end up with $127,903.31 if you make 5% annually (compounding and saving monthly). If you achieve an annual return of 7.5% you will make 79% more in the end. If you doubled the annual rate of return from 5% up to 10%, an achievable goal if you assume the future returns of the S&P 500 will be similar to the past, you would make $424,422.79 or almost 232% more by saving in the wiser way. Of course, with higher returns comes higher risk. Those who have a lower appetite for risk would be advised to save more and invest more conservatively. Of course, past performance is no guarantee of future results, but this should be a compelling argument to know how much you want and provide a basis for how you might achieve your goals.

The main point here is, if you can’t answer my original question, “Are you saving enough?”, WE SHOULD DISCUSS IT!